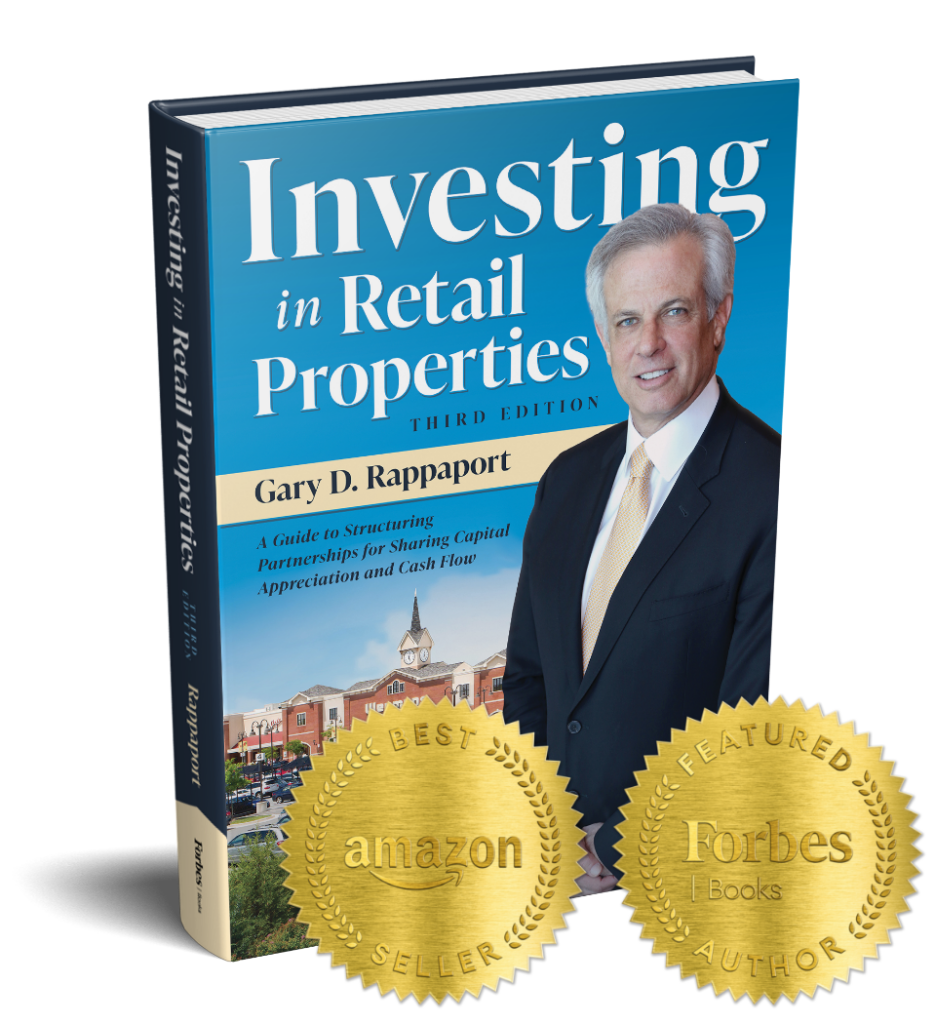

Investing in

Retail Properties

A Guide to Structuring Partnerships for Sharing Capital Appreciation and Cash Flow

About

Gary D. Rappaport

Gary D. Rappaport, author of Investing in Retail Properties: A Guide to Structuring Partnerships for Sharing Capital Appreciation and Cash Flow, was mentored by his own father who instilled in him an incredible optimism and drive for entrepreneurship. Thanks to that drive, he went on to build a vast portfolio of shopping centers and mixed-use projects within the Washington, D.C. Metropolitan area where his namesake company, RAPPAPORT, develops, manages, leases and represents tenants and landlords of retail properties. In September 2023, Forbes Books published the third edition of Gary Rappaport’s book, where he shares his roadmap – built on integrity, hard work, patience, and a healthy tolerance for risk – so that others who are ready to take risks can succeed in the world of commercial real estate.

Get Free Access

Get free access to download two chapters of Investing in Retail Properties – Third Edition when you sign up for our biweekly insights-packed newsletter, the Rapp Up.

What’s in the Book

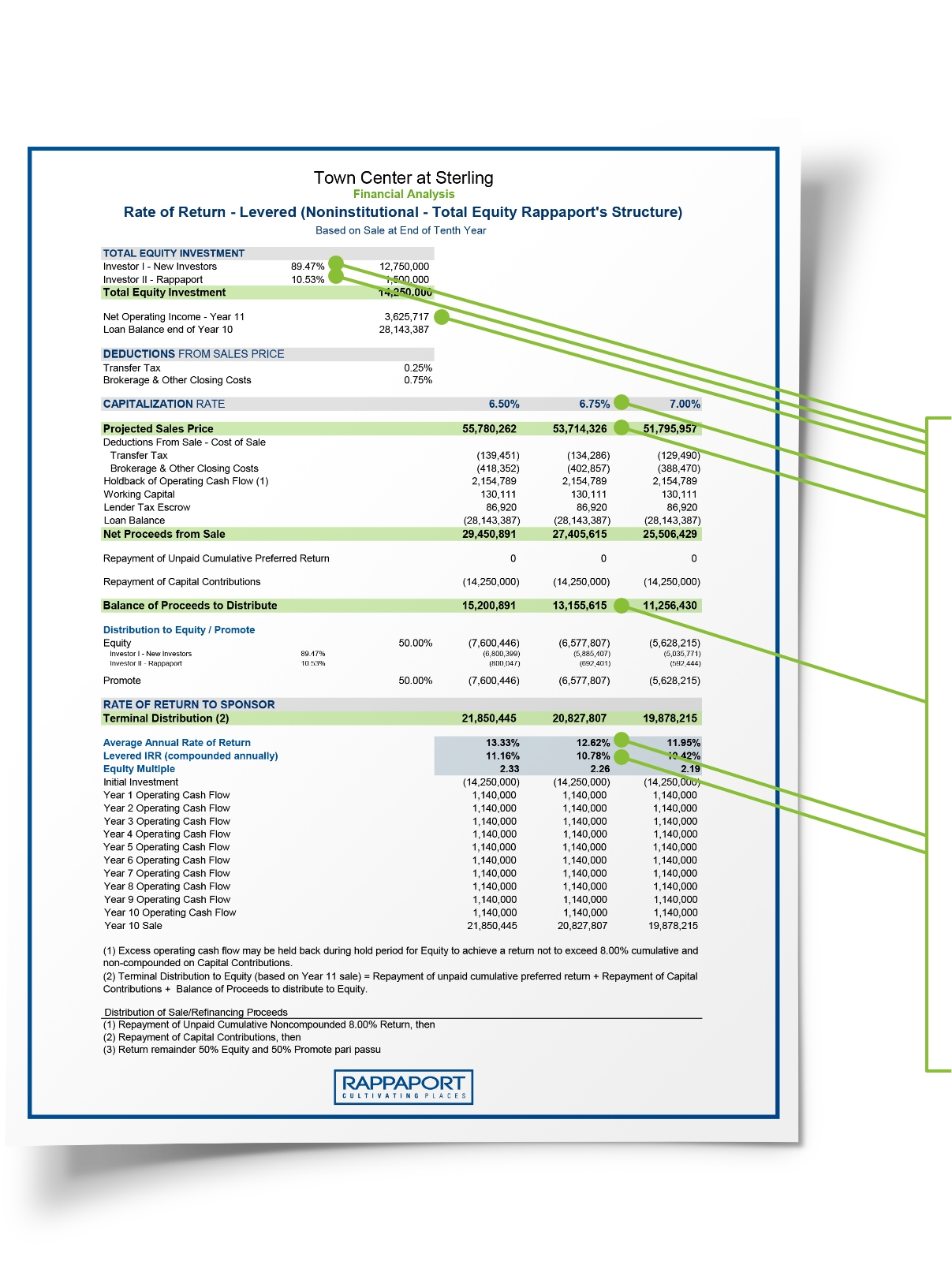

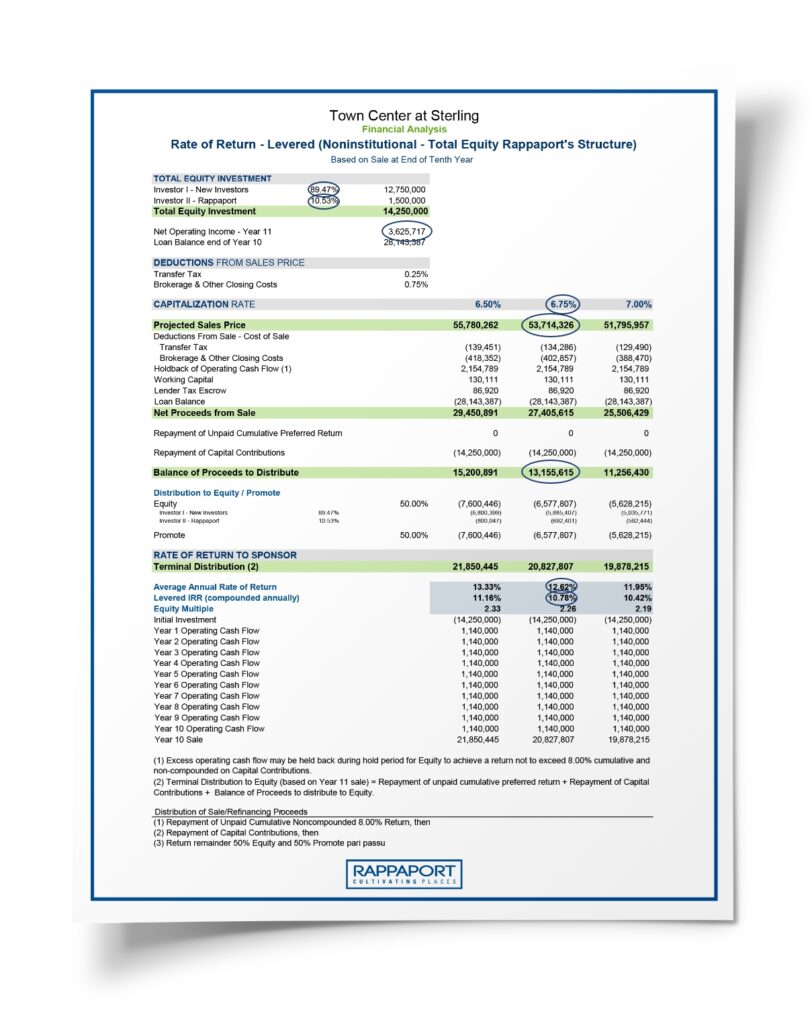

Sample Financial Analysis

Investor group invests: 89.47%

Sponsor invests: 10.53%

NOI year 11: $3,625,717

Midrange cap rate anticipated at the time of sale: 6.75%

Projected sale price: $53,714,326

Proceeds to distribute to the investor group after the repayment of debt: $13,155,615

Average annual rate of return: 12.62%

Levered IRR (compounded annually): 10.78%

Sample Financial Analysis

What’s in the Book

Investor group invests: 89.47%

Sponsor invests: 10.53%

NOI year 11: $3,625,717

Midrange cap rate anticipated at the time of sale: 6.75%

Projected sale price: $53,714,326

Proceeds to distribute to the investor group after the repayment of debt: $13,155,615

Average annual rate of return: 12.62%

Levered IRR (compounded annually): 10.78%

AVAILABLE NOW!

Order Investing in Retail Properties Today.

Order your copy of Investing in Retail Properties, an Amazon Best Seller under the category of Commercial Real Estate.

What People are saying

Book Reviews

GIVING BACK

ICSC Foundation

Gary Rappaport believes in giving back. Through his generosity, he has earmarked 100% of his book royalties to the ICSC Foundation, the charitable arm of ICSC, dedicated to creating a vibrant retail and real estate industry by building a pipeline of bright, ambitious and diverse talent that can drive the industry forward.

Four Decades of Growth

RAPPAPORT has grown to a vast portfolio of shopping centers, mixed-use properties, and open-air grocery-anchored community centers. RAPPAPORT now provides tenant representation, landlord representation, property management, and development services for more than 15 million square feet of retail space throughout the D.C. Metro Area.